MINNEAPOLIS (AP) — The long, expensive court fight over the will of soul singer Aretha Franklin provides a cautionary tale for people who want to make sure their wishes are carried out after their death — and for their families.

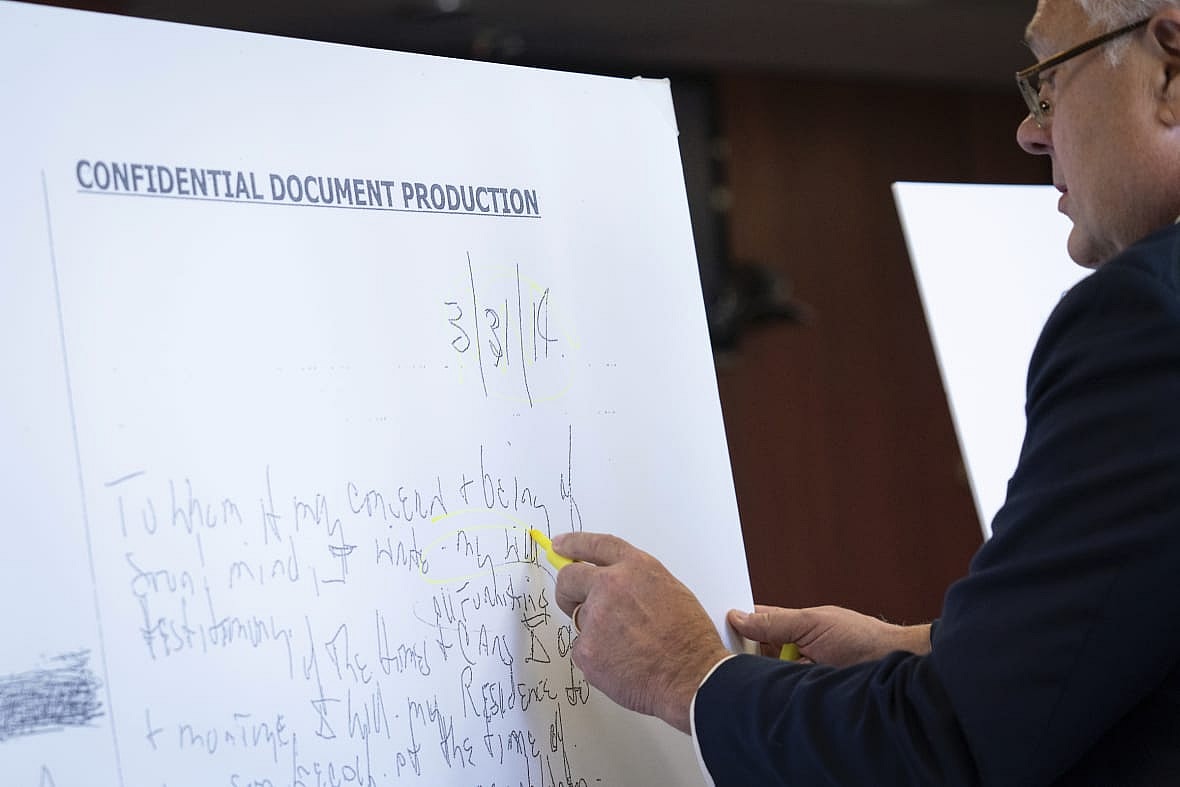

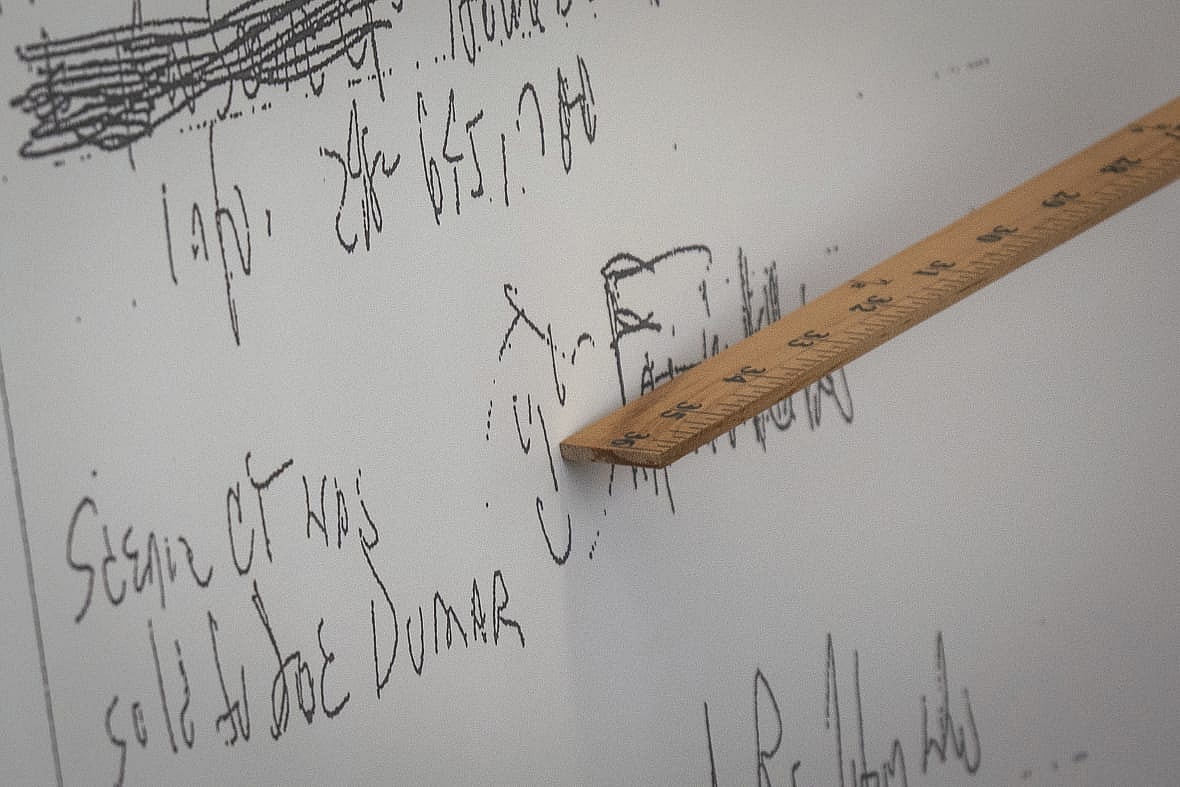

A Michigan jury determined on Tuesday that a handwritten document by Franklin that was found in her couch after her 2018 death was a valid will. It was a critical turn in a dispute that has turned her sons against each other. And it ended in victory for Kecalf and Edward Franklin, whose lawyers had argued that papers dated 2014 should override a 2010 will discovered in a locked cabinet at the Queen of Soul’s home in suburban Detroit.

Legal experts say the fight could have been avoided if Franklin had had a formal will drafted by an experienced attorney who could have ensured that it specified what should become of her money, property and other possessions — and that it would hold up in court. And they say that lesson applies to other families, too. Here’s a look at some of the issues involved:

Do I need a will?

Not necessarily, but estate lawyers strongly recommend them for most people to ensure that their wishes are carried out, and to avoid causing fights among their loved ones.

“Kids fighting after mom and dad pass is the oldest thing in the world,” said Patrick Simasko, who teaches elder law at Michigan State University’s law school and has been following the Franklin case. “That’s the last thing that mom and dad want. That’s the takeaway. Prepare your estate plan so the kids won’t fight after you pass away.”

Estate attorneys often recommend that their clients establish revocable trusts, which can keep the estate out of probate court. That can make the process much less expensive, but the laws vary from state to state.

Can I do it myself?

You can, but Franklin put her family through five years of expensive litigation that could have been avoided. Franklin was working with an attorney about a formal will from 2016-18, but nothing was finalized at the time of her death.

“There were a lot of open questions and we never resolved those open questions,” lawyer Henry Grix testified during the long-running litigation. ““She was quite ill and perhaps unable, really, to reach final intentions.”

Do-it-yourself software such as the popular Quicken WillMaker can cost as little as $99, but those programs can’t customize a will to a family’s unique circumstances and foresee all the potential pitfalls the way a good attorney could.

“People are sometimes pennywise and pound foolish, including people with decent amounts of money,” said Josh Rubenstein, a New York attorney who heads the private wealth department at the nationwide law firm Katten. “But if you have enough money to leave to somebody, you have enough money to hire a lawyer and not do it yourself.”

And although Michigan accepts handwritten wills like Franklin’s, many states don’t.

What happens when someone dies without a will?

Most states have laws covering how an estate should be divided when a person dies “intestate,” meaning without a will, as the vast majority of Americans do, Rubenstein said. But those laws just provide default formulas for who gets what, and they vary from state to state.

Those formulas may not ensure that money, property and possessions get divided the way you want among your surviving relatives, nor do they guarantee who will be named the executor.

A case is point is how rock superstar Prince died without a will in 2016. Under Minnesota law, his estate had to be divided equally among his six surviving siblings, who have had plenty of disagreements since then. The court had to appoint an executor. Lawyers and the trust firm appointed by the court to manage the estate collected millions of dollars that otherwise could have gone to the heirs.

More than seven years after Prince’s death, the case is only now finally winding down. It took until last year for all parties, including the IRS, to agree that Prince’s estate was worth $156.4 million. All of the assets have been distributed except for around $1.4 million in tax refunds that are still coming, court filings show.

TheGrio is FREE on your TV via Apple TV, Amazon Fire, Roku, and Android TV. Please download theGrio mobile apps today!