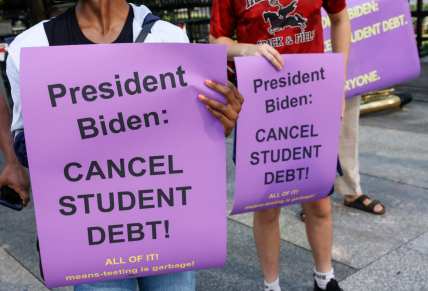

Is Biden’s student loan debt forgiveness plan equitable for Black borrowers?

TheGrio speaks with White House officials, advocates and policy experts to explore how the Biden-Harris administration's relief program will benefit Black households.

The White House’s announcement of its much-anticipated program to cancel student loan debt for millions of Americans emphasizes and addresses the disproportionate impact that debt has had on Black borrowers.

The Biden-Harris administration noted that its plan – which forgives $10,000 for those making less than $125,000 a year ($250,000 for couples) and up to $20,000 for Pell Grant recipients – advances racial equity and targets relief to borrowers with the highest economic need.

“President Biden is very, very sensitive to racial equity in this country,” Keisha Lance Bottoms, former Atlanta mayor and senior adviser to President Joe Biden, told theGrio during a recent interview. “We know that many Black and brown communities are saddled with student debt.”

The Biden-Harris administration has said that the racial disparities in student debt were top of mind when developing its plan, so much so that it asserts the latest actions will likely help narrow the racial wealth gap.

According to a report from the U.S. Department of Education, Black college graduates have an average of nearly $53,000 of student debt compared with $28,000 for white graduates. Even worse, one study found that Black borrowers who began their undergraduate studies in 1995 still owed 95 percent of that debt 20 years later.

Fenaba R. Addo, associate professor of public policy at the University of North Carolina-Chapel Hill, said the racial disparity in student loan debt is largely because white borrowers can pay off their debt more quickly than Black borrowers.

“Black borrowers are holding on to their debt longer over the course of their adulthood, or young adulthood lives, and paying it down slower,” she said. Addo, who along with Jason N. Houle, is the author of “A Dream Defaulted: The Student Loan Crisis Among Black Borrowers,” said “structural factors” inhibit Black Americans’ ability to pay off their student loan debt.

The student debt racial disparity has contributed to broader racial wealth inequality in the United States, said Addo, “both in the accumulation of the debt and in the repayment and how it’s contributing to ongoing persistence of the racial wealth gap within our society.” Additionally, student debt impairs this generation of Black borrowers’ ability to save money to buy a home, she said.

The White House targeted its additional relief for people with Pell Grants – a need-based federal grant for college students – because Black borrowers are more likely to borrow money for college, take out larger loans and are twice as likely to receive Pell Grants. The White House cited a report from Urban Institute that found that debt forgiveness programs for Pell Grants recipients would advance racial equity.

“We know that a significant number of people who are Pell Grant eligible are Black and brown communities,” said Lance Bottoms, a Pell Grant recipient.

“With a combination of Pell grants, work-study scholarships and student loans, I was able to finish school,” she said, “and we know that this is going to be a game changer.”

During Wednesday’s White House press briefing, Susan Rice, White House domestic policy adviser, noted that in addition to the added $10,000 for Pell Grant recipients, Biden has committed incremental increases to the Pell Grant system in his presidential budget, which was approved by Congress. Rice said it was “the largest increase in a decade.”

Despite the administration’s touting relief for Black borrowers, its student debt forgiveness program received criticism. Some advocates said $10,000 isn’t enough. Others contend that a $125,000 salary is not the same economically for Black borrowers as it is for white borrowers. And then there’s the omission of the middle class.

The debt forgiveness program largely benefits only low-income Black borrowers, said Andre Perry, a senior policy fellow at Brookings Institution. Middle-class Black borrowers who may also have graduate degrees, for example, aren’t included.

“There are many Black graduates, collegiates who are now earning middle-class incomes, but are saddled with much more debt than their white counterparts, largely because of past discrimination, which did not allow us or our grandfathers or parents to accrue wealth,” said Perry. He said the administration should have targeted the issue of wealth, or lack thereof, in Black communities.

“As a result, $125,000 doesn’t look the same for most Black people. So you might earn six figures, but a lot of that is going toward your student loan. And it also means that you’re taking a longer time to purchase a home and to acquire wealth.”

He added, “I think the plan does help low-income people of all racial groups. But if you are truly interested in addressing wealth gaps, then you have to give more relief.”

Maya Wiley, president and CEO of the Leadership Conference on Civil and Human Rights, concurs. “Income actually masks the wealth gap between Black and white borrowers, and therefore need,” she said. “It makes the assumption that the need in terms of forgiveness is the same … that happens not to be true.”

One of the loudest criticisms of the White House plan came from NAACP president Derrick Johnson, who said the administration did not meet civil rights organizations’ demand to cancel a minimum of $50,000 in student loan debt.

“If student debt repayments can be paused over and over and over again, there’s no reason why the President cannot cancel a minimum of $50,000,” Johnson tweeted Wednesday. “This is not how you treat Black voters who turned out in record numbers and provided 90 percent of their vote to once again save democracy in 2020.”

U.S. Rep. Ayanna Pressley, D-Mass., who was one of several members of Congress – including Senate Majority Leader Chuck Schumer, D-N.Y., and Sen. Elizabeth Warren, D-Mass. – to also call for $50,000 in debt cancellation, said she is pleased with the Biden-Harris administration’s plan.

“We always want to advance responses and policies that go as far and as deep as the hurt. That being said, this is impactful [and] it is unprecedented action,” said Pressley, who noted that the student debt cancellation movement, once considered a “fringe issue,” has come a long way.

“This is a racial justice issue. It’s an economic justice issue. And the fact that one in four Black borrowers will see their balance canceled outright as a result of this plan – that’s impactful,” the congresswoman added. “I know that some people slept a little bit better last night and woke up this morning a little bit more hopeful. Forty-three million people – that’s nothing to give short shrift to.”

While the administration’s student debt plan is sure to bring relief to Black borrowers who need it most, some advocates express concern about the application process.

Wiley, of the Leadership Conference, said that she worries the income verification paperwork is a “bureaucratic hurdle” that could discourage Black and other minority borrowers.

“You only have to look at anything from food stamps to the Payroll Protection Program (PPP),” she said, “to see that often you have people who either find it difficult or have too many challenges understanding what they have to pull together or being able to get it in a timely fashion and give up or don’t even start.”

“We have to make the process easier, not harder,” said Wiley, who suggested that the Department of Education enable borrowers to allow the agency to access their tax information.

White House press secretary Karine Jean-Pierre told theGrio Thursday, “it’s always a concern” that the application process might limit participation in the debt relief program.

The presidential spokesperson said Biden and Education Secretary Miguel Cardona are committed to ensuring the process is as “simple as possible so that it doesn’t become a bureaucratic headache.”

Concerns and criticisms aside, advocates, members of Congress and administration officials agree the student debt forgiveness program and efforts to reduce debt balances and educational costs –particularly for Historically Black Colleges and Universities (HBCUs) – are a significant step forward.

Senior adviser Lance Bottoms, who is also the director of the White House Office of Public Engagement, said “We don’t always get what we want.” Radical proposals included total debt cancellation, she noted, while Republicans wanted no cancellation.

Also, “President Biden wants community colleges free across this country, and we aren’t there yet,” she explained. “But this is a significant move on the part of the president, and it will make a difference in the lives of up to 43 million people in this country.”

However, Perry, of the Brookings Institution, predicted that the Biden-Harris plan will ultimately cause “the policy dominoes to fall” until there are holistic solutions for deep-rooted issues of wealth inequality and student loan debt. Part of that is establishing a public option for higher education, he said.

“[President Biden] is trying to deal with the past implications of a bad system, but what he needs to do is look into the future,” he said. “At some point, the next group of graduates or loan borrowers are going to say, ‘Well, what about me?’ And it will become a ballot issue for every president. Then we’re going to realize, oh, we need a systemic change.”

Gerren Keith Gaynor is the Managing Editor of Politics and Washington Correspondent at theGrio. He is based in Washington, D.C.

TheGrio is FREE on your TV via Apple TV, Amazon Fire, Roku and Android TV. Also, please download theGrio mobile apps today!