Black graduates’ household incomes have grown more slowly than those of college graduates in general

On average, Black college grads owe more in student loan debt compared to white graduates

College has always been positioned as an opportunity to even the playing field for young adults, and especially for Black students who face a litany of obstacles when trying to advance in their careers.

However, an analysis by the Wall Street Journal (WSJ), found that the median income of Black college graduates in their 30s has plummeted over the past three decades to less than one-tenth the net worth of their white counterparts.

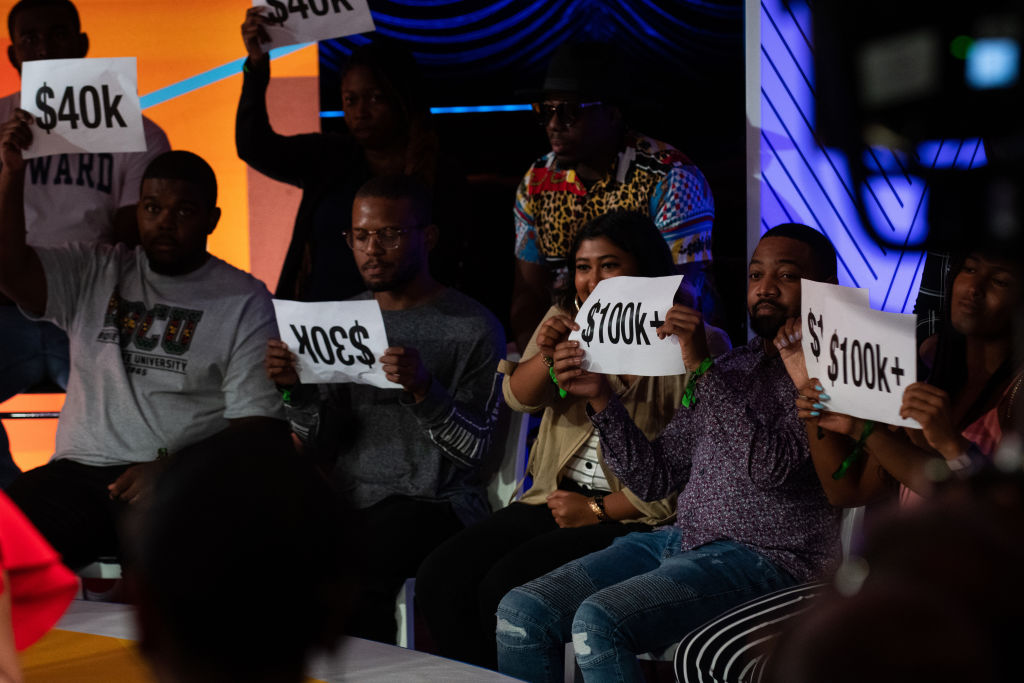

A combination of both student loan debt and the economic crisis has created a tight hold on Black college-educated millennials. More than 84% of their households have student debt, have stopped home buying and don’t have the ability to save.

“The drop is driven by skyrocketing student debt and sluggish income growth,” WSJ reported. “Now, the generation that hoped to close the racial wealth gap is finding it is only growing wider.”

The report also found Black wealth has not grown in the past 30 years.

Student loan debt has always had an impact on the Black community.

According to a 2016 report by Brookings, Black college graduates with bachelor’s degrees owe an average of $7,400 more than White graduates ($23,400 versus $17,000). However, due to interest accrual and post-bachelor degrees, that number increases to Black graduates owing more than $53,000 in student loan debt four years after their bachelors — twice as much as white graduates.

To compare, 35% of Black baby boomers had college loan debt at a median of $6,000. Today’s younger Black college graduates owe a median of $44,000, which is more than seven times the debt from their parent’s generation.

The net worth of Black households in their 30s has also fallen to $8,300 from $50,400 three decades ago.

“Even at the upper end of the Black wealth distribution, average and median wealth are significantly lower than that of white houses at the top of the wealth distribution,” said Fenaba Addo, an professor of public policy at UNC Chapel Hill who studies debt and racial wealth inequality, in a 2020 interview with Market Watch. “This manifests in differences in financial assets, home equity and access to resources that could potentially help their children to pay for college. As college costs have risen, the increasing burden of college costs has shifted from federal and state aid to students and families. People with more resources are able to contribute more.”

As documented in her book, The Whiteness of Wealth, tax law professor Dorothy Brown further explains that even with scholarships and parental support, the hardship for Black students to pay for their degree in higher learning comes from the systematic issues that are present in all structures in America.

“College does not pay off for Black students the way it does for white students,” said the author. “At virtually every step — from taking out loans to facing a racist job market to dealing with repayment plans — Black students and their families have disadvantages. As a result, the Black-White wealth gap widens.”

The WSJ report exemplifies how individual financial habits and behaviors are not enough to solve the issue for Black Americans, but actual structural change is needed in order for Black students to get financial success.

Activists and representatives of the government have put pressure on the Biden administration to provide widespread relief bills to lessen the burden of student loans. In February members of congress, including congresswoman Ayanna Pressley and Senator Elizabeth Warren, reintroduced a resolution to cancel $50,000 in student loan debt.

In late June, Majority Leader Chuck Schumer renewed his pleas to President Biden to cancel the $50,000 in student loan debt.

However, Speaker of the House, Nancy Pelosi has stated that Biden does not have the legal authority to cancel student loan debt.

Have you subscribed to theGrio’s “Dear Culture” podcast? Download our newest episodes now!

TheGrio is now on Apple TV, Amazon Fire and Roku. Download theGrio.com today!