Want a healthier Black America? Cancel student debt

OPINION: Not canceling student loan debt for Black Americans is crushing our hopes and dreams and any chance at becoming a healthier community

Growing up poor or first-gen in America means that you were likely sold the ‘American Dream’ myth — education as the only key to financial freedom, more degrees equals more money, and the ideal that meritocracy, where people are fairly and equally rewarded for their hard work, reigns supreme.

If you feel triggered it’s because you’ve been lied to — welcome to being Black in America.

Read More: New study reveals Black millennials, Gen-Zers believe in the American Dream

Economic health is wealth, but our nation’s financial aid system is failing us. Never before has a college degree meant so much in this highly competitive global marketplace, yet the enormous financial barriers standing in the way of earning that degree, put many Americans, especially Black Americans, behind the eightball.

The cost of higher education has skyrocketed in recent decades, but average wages, especially for those at lower income levels, have not increased to match it. Recent data shows that from 1987 to now, public and private university tuition costs have gone up by about 150%, while minimum wage and early career salaries have gone up by just 20% and 3% respectively, when adjusted for inflation. This helps to explain how educational costs contribute to our exaggerated U.S. wealth gap.

The racial wealth gap is widened even further by structural racism, which leaves Black people with little disposable income to offset educational costs such as tuition, housing and meal plans. Black Americans who aspire to use education as a vehicle for upward mobility are forced to take out student loans with high-interest rates.

According to Business Insider, 86.6% of Black students borrow federal loans to attend four-year colleges, compared to 59.9% of white students. After four years, Black undergraduates hold almost twice as much in student debt as their white counterparts at $53,000.

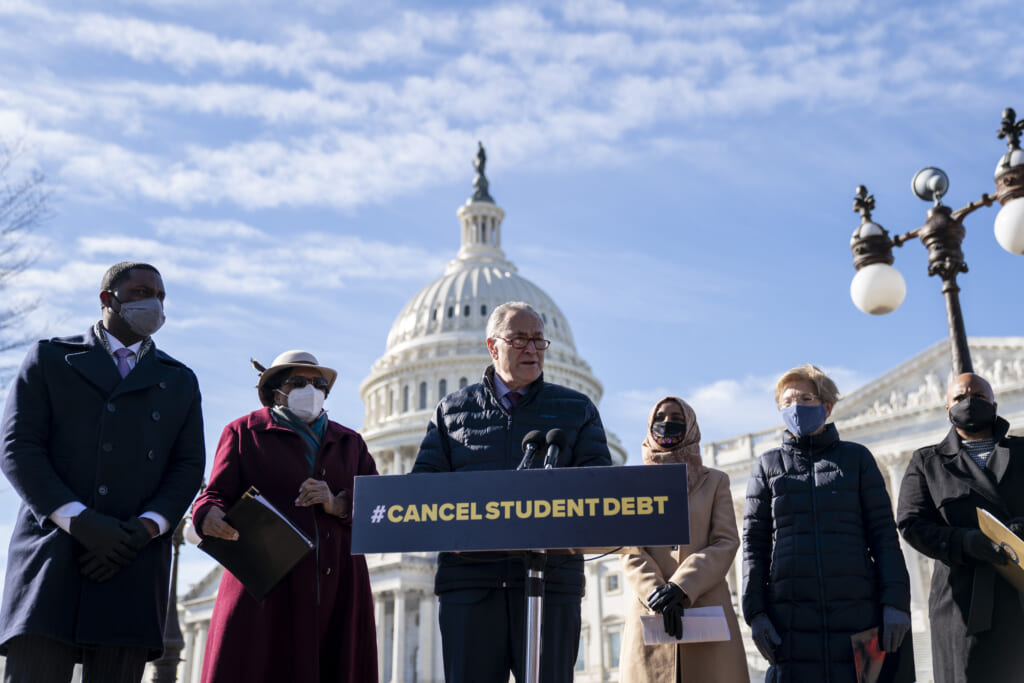

Read More: Dems apply public pressure on Biden after he balks at student debt forgiveness

These statistics are even worse for Black graduate students. The Center for American Progress found that Black students were more likely to borrow money to attend graduate school than white students, resulting in a 50% higher median debt burden than their white peers. Black graduates often have to borrow higher amounts of money as well. Black graduate students’ federal loans are, on average, $25,000 higher than white graduate school graduates; and Black graduates earn less money out of college, making it harder to pay off their loans.

To make matters worse, colleges downplay the potential long-term economic and social impacts of student loan debt. Conversations about financial literacy are few and far between; and the financial minutia like compound interest and the consequences of defaulting on your loan are often not explained, or not explained well, leaving these young borrowers in the dark about what they have truly signed up for.

After graduation, Black grads are left with a hefty bill. The financial strain causes stress, anxiety, and depression in borrowers who struggle to keep up with their payments and other obligations, while navigating complex work environments for the first time. With mounting debt, many young Black Americans are forced to defer their career paths or put off other dreams, like getting married or buying a home.

Data shows that mounting student debt influences decisions on employment. According to a 2010 survey conducted by Princeton University, Black college students reported that they were more likely to choose a certain career path based on their ability to pay off student loans rather than fulfilling a mission. Twenty-one percent claimed that they were delaying marriage or buying a home.

Read More: HUD Secretary Marcia Fudge’s agenda targets homelessness and homeownership

For Black people eliminating student debt would result in significant leveling of the racial wealth gap in this country. The racial wealth gap is the number one social determinant of health that contributes to health disparities such as higher rates of diabetes, obesity, asthma and heart disease. Income is a significant contributor to good health. Wealth often determines one’s proximity and access to healthcare resources, safe neighborhoods, healthy foods, reliable transportation, and low pollution areas.

The Roosevelt Institute, a liberal think tank based in New York, found that white households headed by people between the ages of 25 and 40 have 12 times the amount of wealth on average than Black households, so unsurprisingly, many white people enjoy better health than Black people. By eliminating student debt, the aforementioned ratio would be just five times the amount of wealth, likely decreasing the increased morbidity and mortality rates that result from income inequality.

We need student debt relief and we need it now. A slumping economy and the disproportionate impact of the coronavirus on Black populations have resurfaced discussion around the racial wealth gap, even prompting senators Elizabeth Warren and Bernie Sanders to address the issue during their presidential campaigns. Both called for $50,000 of federal student debt forgiveness, which would eliminate debt for 80% of Americans, benefitting women and people of color the most.

Many Americans were skeptical of robust loan forgiveness at first, but the prospect of lessening economic gaps while jumpstarting the economy has changed some minds. A recent survey of over 1,000 people conducted by Invisibly found that 60% of people are in favor of outright student loan forgiveness with an additional 22% in favor depending on whether it is forgiveness of subsidized or unsubsidized loans. The numbers in favor of loan forgiveness were even higher for those who currently have student loan debt.

There is no doubt that it is much more difficult than it used to be to work your way through college and to pay for it afterward. Student loan debt is holding an entire generation from buying homes, starting small businesses, and saving for retirement. It is crushing the hopes and dreams of many Black Americans — and any chance we have at becoming a healthier Black America.

President Joe Biden, if you are listening, cancel student loans — it’s more than an acute economic jumpstart, it’s the type of generational lift that can positively impact our economy and the lives of young people for years to come.

Dr. Shamard Charles is an assistant professor of public health and health promotion at St. Francis College and sits on the anti-bias review board of Dot Dash/VeryWell Health. He is also host of the health podcast, Heart Over Hype. He received his medical degree from the Warren Alpert Medical School of Brown University and his Masters of Public Health from Harvard’s T.H. Chan School of Public Health. Previously, he spent three years as senior health journalist for NBC News and served as a Global Press Fellow for the United Nations Foundation. You can follow him on Instagram @askdrcharles or Twitter @DrCharles_NBC.

Have you subscribed to theGrio’s podcast “Dear Culture”? Download our newest episodes now!

TheGrio is now on Apple TV, Amazon Fire, and Roku. Download theGrio today!