One of the country’s largest community development organizations has closed on $122 million in investments for Black-owned banks and businesses.

The Local Initiatives Support Corporation (LISC) manages the Black Economic Development Fund (BEDF), an investment fund that helps close the racial wealth gap. The corporation made the announcement in a press release.

“Over the last two years, there has been a lot of public debate about how best to support the advancement of racial equity,” George Ashton, president of LISC Fund Management, said.

“This fund is a powerful model for social investing that helps corporations leverage their treasury dollars to fuel revenue and employment growth for Black-owned businesses, so they can deepen their impact on the communities in which they operate,” he continued.

The LISC launched the development fund last summer as part of a $1 billion strategy to address racial health, wealth and opportunity gaps.

Black businesses have had, historically, more limited access to capital. That lack of money makes it hard for businesses to grow. The development fund has, so far, provided financing for community development projects, real estate development and more.

Among the investments is a nearly $1.7 million loan in Cleveland that will go towards converting two Victorian-style homes and a carriage house into 19 studio and one-bedroom apartments. The apartments, near the Cleveland Clinic and Case Western University, will offer below-market-rate housing for students and professionals.

Another investment is a loan of about $2.5 million to improve a 141-unit affordable housing development in a majority Black community in Chicago. The company also said it gave a $5.75 million construction loan in Orlando for affordable housing in West Lakes, a historically Black community.

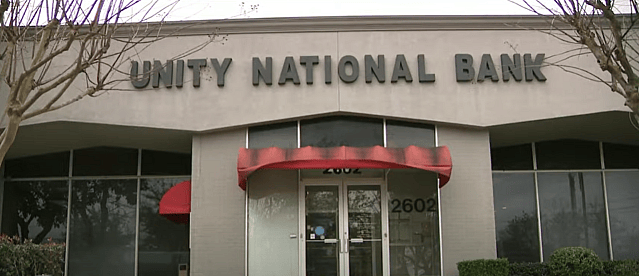

The BEDF is also supporting Black-owned banks in Houston and New York. The BEDF deposited $3 million in Houston’s Unity National Bank, the only Black-owned bank in Texas. It also made a $5 million deposit in Carver Federal Savings Bank in New York, which provides capital to underserved communities.

The press release said the BEDF will close the rest of its investments by the end of the year.

TheGrio is FREE on your TV via Apple TV, Amazon Fire, Roku, and Android TV. Please download theGrio mobile apps today!