What the rise of GoFundMe’s to pay medical bills says about US health care system

OPINION: The marker of a successful nation is the health of its citizens, not the amount of money that it makes.

In an era of rising health care costs and budget constraints, an increasing number of Americans are finding it nearly impossible to pay for much needed health care services — so they’re turning to strangers for help.

Crowdfunding, or digital fundraising that circumvents the need to allure individual investors, has quickly emerged as a popular option for entrepreneurs to validate their ideas. Its success has been so profound that many have lobbied the kindness of others on platforms like GoFundMe and Fundly to help pay for everything from college tuition to funeral costs.

Fundraising isn’t new — consider bake sales, telethons, pledge challenges, or the Salvation Army drum. Some argue that charity is central to any humanitarian response; but what does the explosion of crowdfunding for medical expenses say about the U.S. health care system?

Is health a human right or a privilege?

A staggering number of Americans rely on crowdfunding to cover gaps in medical costs. According to Tim Cadogan, the CEO of GoFundMe, one-third of all donations — over 250,000 campaigns raising $650 million — on the popular fundraising site has gone toward health care costs.

While the generosity of our neighbors should be applauded, the reliance on crowdfunding as a lifeline for many Americans, to not only cover health care costs but to also pay bills and put food on the table, is a reminder that health is not a human right in this country. The right to health for all people means that everyone should have access to the health services they need, when and where they need them, without suffering financial hardship, but in the U.S. this is hardly the case, so any serious illness comes with the potential of crippling financial burden.

To avoid such hardship people are willing to risk further damage to their health by skipping doctors appointments or cutting doses of (and sometimes simply abstaining from) life saving medications. As a doctor, I have seen patients request an Uber while enduring pain from serious injury, to avoid an exorbitant ambulance bill; and far too many put off screening tests like mammograms and colonoscopies jeopardizing their likelihood of early diagnosis and cure. On the other hand, I have seen families make major sacrifices to make ends meet — mothers and fathers who take unpaid leave to care for their sick children, reducing their family to a single income and families risking long-term financial ruin by refinancing their house or selling it altogether, to afford expensive drug treatments or novel therapies like cancer immunotherapy.

For many Americans, stories like these are far too common so it’s no wonder that so many rely on the kindness of strangers. For millions of people, crowdfunding has alleviated financial pressure at an agonizing time. But with every pro there’s a con.

Crowdfunding unknowingly propagates a symptom of a flawed and inefficient health care system that provides the best care in the world to those who can afford it, while forcing millions of others to either plunge into debt or leave their illnesses untreated. Forcing people to compete for funds exacerbates the inequalities that currently divide the country, while leaving the root cause of those systemic inequalities unaddressed.

Why is health care so expensive?

The three driving forces behind high health care costs are administrative expenses, corporate greed and price gouging, and higher utilization of costly medical technology.

U.S. health care is based on a for-profit insurance system that is largely administered by private companies. Insurance coverage is subsidized by an employer with individuals paying the rest. In case you wonder about how to get a cheap insurance quotation, you might want to Compare term and universal quotes for life Insurance on your parents using this post.

Because of health insurance policies that have high deductibles, or that cover only part of the bills, many Americans lack sufficient health insurance. Many more simply go without it. A large portion of the U.S. workforce have “essential” jobs. These low income, oxymoronically named jobs, often come with the risk of working in hazardous environments under high stress. They require more contact with potentially sick people and less social distancing. During a global pandemic, it would make sense for these potential superspreaders to have health insurance, but this is not the case, prompting some social behavioral scientists to demand that the U.S. government to call these workers what they really mean, sacrificial.

Among the uninsured, finding a provider who offers affordable services is challenging at best, and the wait for an appointment with a provider offering free or reduced-price services can be considerable. The medical practice of routinely ordering unnecessary laboratory tests and expensive imaging technologies adds another layer of complexity to an already muddled situation.

For those with Medicaid coverage — government-assisted insurance for low-income individuals who meet eligibility requirements — state budget constraints may affect the eligibility for coverage, the services offered, or the ability to find a provider willing to accept the Medicaid fee schedule. Older adults covered by Medicare face copayments and bear the rising costs of prescription medications during a time where they need health care the most. Even those with private insurance are stuck, with many middle class Americans who have worked hard to attain the socioeconomic status that rewards them with robust private insurance plans, left with plans that do not cover an adequate amount of their health costs to ensure access to quality health care. Even when you do everything right, it is likely that you will still face some difficulty paying for care with rising premiums, deductibles, and copayments.

More and more middle class Americans are simply having to contribute a greater percentage of their hard-earned dollars to health care. A report by The Commonwealth Fund, found that rising premium and deductible contributions have outstripped wage growth over the past decade — between 2008 and 2018 median income grew 1.9% per year on average, rising from $53,000 to $64,202, while middle-class employees’ premium and deductible contributions rose much faster, nearly 6% per year over that same decade.

Little bang for your buck

Even with expanded health care coverage by way of the Affordable Care Act and some of the best hospitals in the world, the U.S. is one of the unhealthiest countries in the world. Americans have a lower baseline of health than most people around the world, because we are the only industrialized nation without universal health coverage. Maternal mortality and child infancy rates are frustratingly high; and despite spending more on health care as a share of the economy — nearly twice as much as the average industrialized country — the U.S. has one of the lowest life expectancies and the highest suicide rate among all high resource nations.

With millions of Americans still unemployed and the Covid-19 pandemic showing no signs of slowing, many are uncertain if they’ll be able to pay for all their health care needs. A recent joint survey conducted by West Health and Gallup found that a whopping 46 million U.S. adults — one-fifth of Americans — cannot afford necessary healthcare services. About two thirds also say that they have some level of concern about whether they will be able to pay for health care.

Low-income Americans suffer the most

A sizable number of Americans live paycheck to paycheck. Research conducted by LendingClub Bank, a leading digital marketplace bank, found that over half of Americans — about 125 million U.S. adults — are living paycheck-to-paycheck, with 21% of this population struggling to pay their bills. Forty percent report that they don’t have $400 in their account to cover an emergency. With little or no money left over after spending their income it is no surprise that crowdfunding has become a first stop and last resort when tragedy strikes and health insurance, if any, falls short.

One possible reason for the rising demand in crowdfunding health care costs could be the drop in health insurance coverage in recent years. According to a recent Gallup poll, uninsured rates in the U.S. have reached a four-year high, with nearly 13.7% adults in the U.S. reporting they are uninsured. After a year of severe job market disruption, seven million more adults are without insurance, the highest number since the Affordable Care Act’s individual health insurance mandate was put into effect in 2014.

Provocative storytelling wins

Rising unemployment rates and a widening income gap means that those who are uncertain if they’ll be able to pay for basic necessities like food and housing are likely to put their health care needs on the backburner without outside assistance. That’s why raising funds to pay for health care is a go-to approach.

The competition for funds is so salient that fundraisers have perfected their pitch. It’s no secret that when patients turn to crowdfunding, whoever has the most heartrending story wins. Successful crowdfunding campaigns are not based on the number of people helped (or who needs what the most), but rather how effective your story pulls at the heart strings of potential donors. Highly unregulated crowdfunding sites, much like the U.S. health care system, are subject to con artists taking advantage of the system. In 2016, Kate McClure and Mark D’Amico made national headlines when it was found that the couple famously concocted a heartfelt story about helping a “homeless” man living under a Philadelphia bridge, Johnny Bobbitt Jr., defrauding hundreds of donors (to the tune of $400,000) along the way.

Since then countless others have been exposed. Some have faked personal illnesses, while others have used photoshopped pictures and forged HIPAA-violating medical documents to corroborate stories of sick family members. Companies like GoFundMe and MedGift.org have taken steps to lessen the possibility of fraud, but this is nearly impossible, and quite frankly infinitesimal compared to what needs to be done.

What must be done

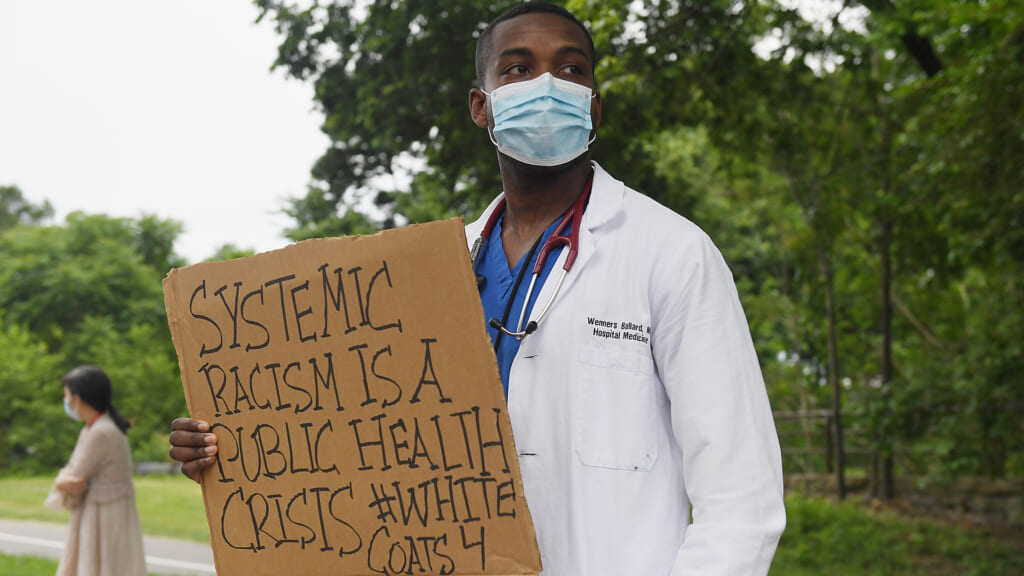

The marker of a successful nation is the health of its citizens, not the amount of money that it makes. The U.S. has lost sight of that and we are paying the price. Big Pharma must lower drug prices so that they are affordable, universal health care must become the norm, and Congress must enact policy to raise the minimum wage. The racial-wealth gap, health inequities, and inefficient health care spending borne out from this fragmented, for profit health care must be addressed. Having to rely on donations to simply access health care resources is shameful and a stain on the U.S. health care system and makes people wonder why we have a government to begin with.

Fortunately, with tragedy comes opportunity. Let’s hope the pandemic spurs a renewed effort to put people first. Let’s make it our duty to demand health care for all because getting the bare minimum isn’t a privilege, it’s our right.

Dr. Shamard Charles is an assistant professor of public health and health promotion at St. Francis College and sits on the anti-bias review board of Dot Dash/VeryWell Health. He is also host of the health podcast, Heart Over Hype. He received his medical degree from the Warren Alpert Medical School of Brown University and his Masters of Public Health from Harvard’s T.H. Chan School of Public Health. Previously, he spent three years as senior health journalist for NBC News and served as a Global Press Fellow for the United Nations Foundation. You can follow him on Instagram @askdrcharles or Twitter @DrCharles_NBC.

Have you subscribed to theGrio’s “Dear Culture” podcast? Download our newest episodes now!

TheGrio is now on Apple TV, Amazon Fire and Roku. Download theGrio.com today!