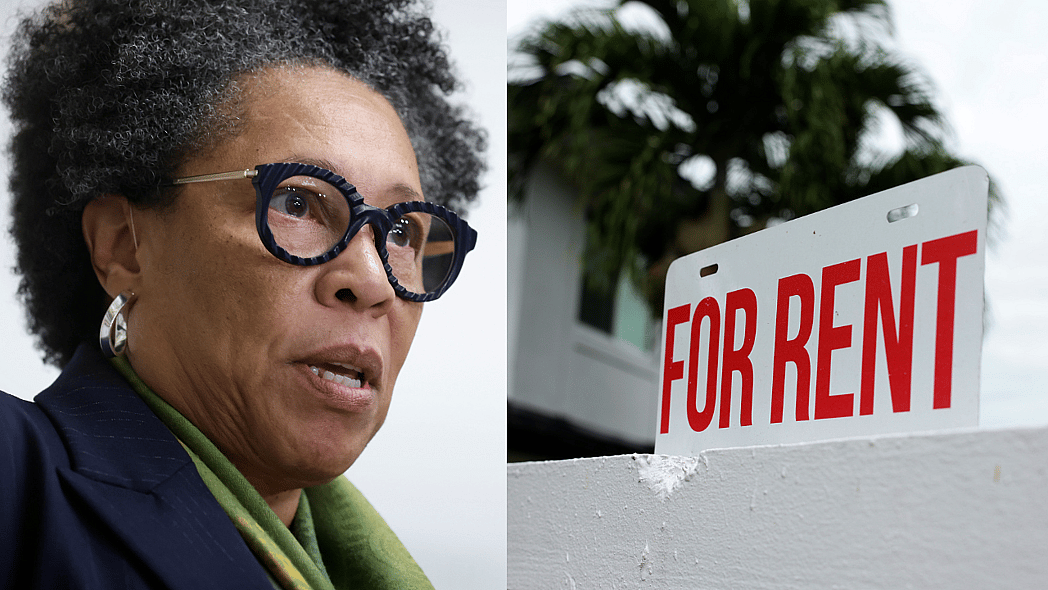

“The rent is too damn high!” says Marcia Fudge, secretary of the U.S. Department of Housing and Urban Development, in reference to the campaign phrase popularized by former politician Jimmy McMillan.

“He was absolutely right…I agree with him 100%,” said Fudge, head of the federal agency created in 1965 to address America’s housing and urban challenges, during a sit-down interview with theGrio.

A recently published Joint Center for Housing Studies report from Harvard University found that a record half of U.S. renters are paying rent considered to be unaffordable, which is 30% or more of their income on rent and utilities. Black and brown renters, considered to be the most “cost-burdened,” are paying 50% or more of their earnings on rent.

Black households are also more likely to have lower incomes than other races and ethnicities, the Harvard study points out, due to racial discrimination in education and labor markets.

Secretary Fudge noted that U.S. rent is persistently high due to a continual short supply of housing units.

“We don’t have enough units of rental housing to create some competition,” said the Biden-Harris administration official, who said some landlords and real estate owners are “gouging people because they know that they can get more.”

She added, “Until we can build more rental units, the prices are not going to go down significantly.”

When asked about the new study on the high cost of housing in America and the impact on Black households, White House Press Secretary Karine Jean-Pierre told theGrio that the study was conducted through 2022 and that incomes for Black households have slightly increased in recent years.

Still, the spokesperson for President Joe Biden acknowledged that housing affordability “remains a challenge” for Black and brown communities.

“While for decades there has been no action…this president has taken some action to [make] sure that we’re lowering housing costs,” said Jean-Pierre.

Fudge said the Biden-Harris administration is “encouraging multifamily building” through lending with HUD’s Federal Housing Authority and the Community Development Block Grant. The HUD secretary also highlighted the agency’s billion-dollar tax credits toward constructing new low-income rental housing.

Fudge said HUD hopes the actions will also lead to more Black and minority developers building housing in communities that need it the most.

Another way the Biden-Harris administration is tackling the disproportionate cost of housing for Black and brown households is addressing the issue of junk fees.

“When you think about those kinds of fees – application fees, background check fees – they become very expensive to the point where it almost could be worth a month’s rent,” explained Fudge.

A White House fact sheet claims that application fees often “exceed the actual cost of conducting the background and credit checks.” In July 2023, the administration announced commitments it secured from rental housing platforms Zillow, Apartments.com, and AffordableHousing.com to provide consumers with “total upfront cost information on rental properties, which can be hundreds of dollars on top of the advertised rent.”

HUD also provides housing vouchers to qualified renters through its housing choice program. A White House spokesperson told theGrio that the Biden-Harris administration expanded the number of households receiving vouchers and other rental assistance programs by about 130,000.

Fudge clarified, “We have given more vouchers in our time here than have been given out in the last 20 years.”

In addition to assisting renters, the Department of Housing and Urban Development is working to bring down the cost of mortgages, especially for Black Americans, as the racial gap in homeownership is as high as it was in the 1960s.

In response to the high cost of mortgages, HUD moved to reduce its annual mortgage insurance premium through the Federal Housing Administration (FHA), which insures home mortgages for millions of Americans every year.

Fudge highlighted other efforts by HUD to ease costs for potential homebuyers, like changing how student loan debt is calculated in FHA underwriting to avoid placing an unfair disadvantage for borrowers when seeking a mortgage. The department sought to provide relief to Black and brown communities through other means like holding counseling sessions for prospective homebuyers and establishing programs for first-time home buyers.

In his 2024 budget proposal, President Biden requested a $1.1 billion increase in federal funding for HUD programs designed to serve more American households, particularly Black and brown. However, Congress has been slow to approve Biden’s budget due to grumblings in the Republican-controlled U.S. House of Representatives.

Fudge, a former member of the House, told theGrio she hopes Republicans approve the president’s budget increase for HUD programs, which she said is evidence that President Biden is “very committed to addressing the housing crisis in this country,” which includes the cost of rent, mortgages, and challenges of homelessness.

“If the Congress does not pass a budget and we continue to work on continuing resolutions, we’re going to be able to serve fewer people,” said Fudge. “If they continue to just operate just month after month after month with the same budget, when we know that we need more resources, people are going to be left out.”

Gerren Keith Gaynor is a White House Correspondent and the Managing Editor of Politics at theGrio. He is based in Washington, D.C.

Never miss a beat: Get our daily stories straight to your inbox with theGrio’s newsletter.