IRS says Black taxpayers may be audited at higher rate

Using statistical techniques utilizing name data and census block groups, Stanford University researchers found that Black taxpayers' audit rates may be up to five times greater than those of whites.

The Internal Revenue Service has discovered information suggesting Black taxpayers may be subject to audits at a significantly higher rate than non-Black taxpayers.

Stanford University researchers found that Black taxpayers’ audit rates may be up to five times greater than white taxpayers.

According to The Hill, Senate Finance Committee Chairman Ron Wyden, D-Ore., requested that IRS Commissioner Daniel Werfel look into the situation after the latter assumed leadership earlier this year of America’s federal tax collection agency.

In a letter to Wyden, The Hill reported, Werfel wrote that early IRS findings “support the conclusion that Black taxpayers may be audited at higher rates than would be expected.” He said the agency is therefore “dedicating significant resources to quickly evaluating the extent to which IRS’s exam priorities and automated processes, and the data available to the IRS for use in exam selection, contribute to this disparity.”

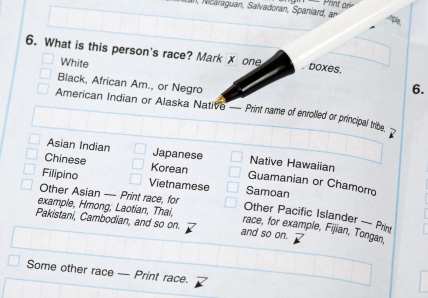

Although the IRS does not keep track of the race or ethnicity of specific taxpayers, Stanford University researchers were able to deduce racial information using statistical techniques utilizing name data and census block groups.

The main reason for the variance, the study found, surrounded the handling of audits involving a tax incentive known as the Earned Income Tax Credit, which provides credits to those at the lower end of the income scale that can total up to $7,430, depending on how many children they have.

The greater cause of the discrepancy is the selection of taxpayers targeted for auditing within the community of claimants: Black taxpayers who claim the EITC are reportedly between 2.9 and 4.4 times more likely to be audited by the IRS than their non-Black counterparts. Audit rates between Black and non-Black taxpayers who do not claim the EITC show a smaller difference — although still statistically significant, researchers found.

The IRS algorithm that chooses EITC tax returns for audit may be racially biased in some ways, they note, such as targeting incorrectly received credits and only choosing uncomplicated returns for audit. The Joint Committee on Taxation said the EITC costs around $75 billion yearly.

Werfel’s letter comes as the IRS undergoes extensive renovations and system upgrading, thanks to Congress’ $80 billion financial boost last year. The agency is hiring tens of thousands of employees and undergoing an operational redesign to centralize much of its enforcement and collection procedures, possibly modifying the mechanisms that result in higher audit rates for Black taxpayers.

In response to a question on whether taxpayers should sue the IRS for racial discrimination policies, Alice Thomas, an associate professor at Howard University Law School, said that to do so, “We’ve got to get buy-in from the law firms to supply their associates to do pro bono cases.”

Thomas continued by saying that rather than suing the IRS, she is more interested in alerting the agency to the problem. She noted that unintentional biases could result in unfair and discriminatory actions in people and statistical processes.

“Behind the people doing the audits [can be] people who have unconscious bias,” she added, “so we have to wake people up.”

TheGrio is FREE on your TV via Apple TV, Amazon Fire, Roku and Android TV. Also, please download theGrio mobile apps today!