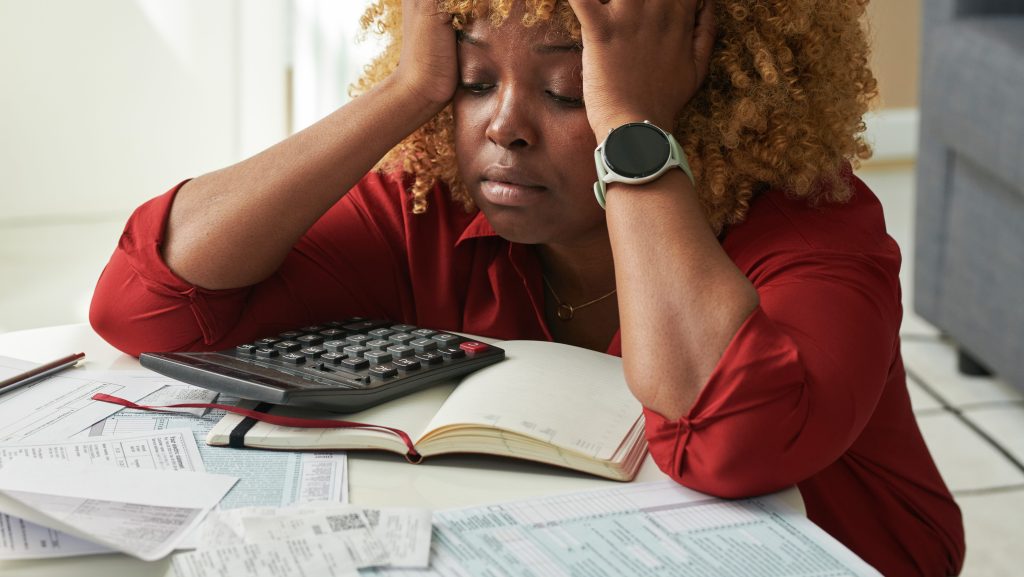

You found out you owe taxes; now what?

If you've been hit with an unexpected tax debt, you've got options that will save you anxiety and money in the long term.

You finally pulled together all of your W2s and receipts and got them to your accountant, tax preparer, or sat down in front of the computer to file your taxes yourself — but once it’s all you said and done, you find out that instead of a refund, you actually owe taxes! What do you do now?

If you haven’t hit the “send” button on that filing yet, you may think you can put it off or even wait until next year to deal with it. But as we’ve previously advised, you should not do that; it will actually cost you more money.

Here is what to do if you end up owing Uncle Sam this year:

File your taxes by April 15 even if you cannot pay what you owe on April 15

According to the IRS, you should still file your taxes by the 15th and pay what you can at that time. When you don’t file on time or don’t pay anything towards what you owe, the interest and penalties can add up quickly.

The IRS Failure to File Penalty is 5% of the unpaid taxes for each month or part of a month that your tax return is late. The penalty will not exceed 25% of your unpaid taxes, but it will be applied to your balance every month, which can add up to a lot of money. Bottom line? It is never advantageous to not file your taxes by the deadline. Got it? Good.

Set up a payment plan with the IRS

If your budget can’t accommodate paying the entirety of what you owe upfront, you can actually go online and apply for a payment plan with the IRS. There are two options to pay your tax debt down over time, and you may qualify to apply online if you meet the following criteria:

- Long-term payment plan (installment agreement): You owe $50,000 or less in combined taxes, penalties and interest. You have filed all required returns.

- Short-term payment plan: You owe less than $100,000 in combined taxes, penalties and interest.

If you are approved for a payment plan, there is no set-up fee for a short-term payment plan. If you need to establish a long-term payment plan, there is a $31 set-up fee.

Recommended Stories

As a financial expert, this is what I would advise anyone who finds themselves owing taxes to do: Apply for the payment plan, get approved and immediately start paying it off. Make the monthly payments a part of your budget and get it taken care of.

Do NOT ignore it

I cannot stress this enough: Do not ignore that tax bill. Owing the IRS is not fun, but you cannot just act like it does not exist. It’s not just the interest and penalties that will add up, but the IRS can place a lien on your property or garnish your wages. It’s best to be proactive and make a plan to pay it off.

No one wants another bill, especially not in this economy, and an unexpected tax bill can really catch you off guard. Nevertheless, this can be a temporary issue if you take advantage of the resources available instead of panicking or putting it off. If you make a plan quickly and stick to it, it might be over before you know it!

Jennifer Streaks is Senior Personal Finance Reporter and spokesperson at Business Insider and a financial contributor at The Grio. A nationally recognized expert on money and affordable lifestyle living, Jennifer is an established financial columnist who has been featured on CNBC, Forbes, ABC, MSNBC, CBS, and more.