‘That’s The Point’: Why student loan debt cancellation is about racial justice

In our debut episode of "That's The Point," theGrio's Natasha S. Alford breaks down the debate over canceling student loan debt.

As the call for student loan debt cancellation grows louder each week, the question of why it should be canceled seems to grow right along with it.

“I paid off my student loans, not my problem,” is the statement echoed by former borrowers. “Pay off my loans now Uncle Joe, and make it $50,000 while you’re at it,” others say, while still swimming in educational debt.

Although student loan debt cancellation is a universal struggle for Americans (we owe about $1.75 trillion in student loan debt as a nation), Black student loan borrowers face a far heavier burden.

In our inaugural episode of That’s The Point, theGrio‘s new politics and culture show, we’re looking at why the debate surrounding student debt cancellation is more than an economic conversation.

Here are the topics we cover in the episode above:

Black students are more likely to take on larger amounts of debt, and once they’re in the workforce, the return on their investment isn’t always immediate.

Factors like workplace discrimination and needing to work a job right away, even if it’s not in their intended career field, leave Black graduates behind, according to research by professors Darrick Hamilton and Naomi Zewde.

Black women, in particular, face even more of a burden. A new report by the Education Trust says Black women are stuck with more educational debt than other racial groups because they tend to be paid less than men and face additional barriers of racism.

“Black women must obtain a bachelor’s degree or higher to earn more than

white men who have some college but no degree,” says the report. “In other words, Black women need additional credentials to compete in the labor market, but they get a lower financial return on their college investment than men of all races…”

For Democrats, whether President Joe Biden actually cancels student loan debt may end up being a “make or break” issue at the polls this midterm. Many Black voters say their education debt is top of mind and apparently when Joe Biden makes a promise, people are listening.

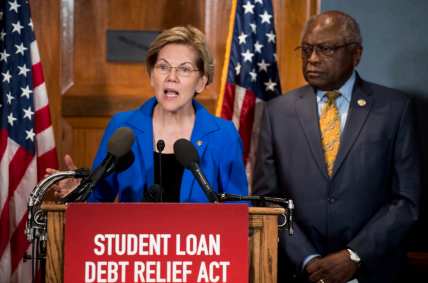

While campaigning for president back in 2020, Biden expressed support for federal loan forgiveness of approximately $10,000 minimum per borrower. The actual legislation Biden referred to was proposed by Sen. Elizabeth Warren (D-MA), but voters heard his message loud and clear — student loan debt was a significant issue, and loan forgiveness would be a priority.

One year into his term, President Biden has made good on some promises, canceling about $24 billion dollars in debt by targeting certain groups including those defrauded by predatory institutions, public servants such as teachers and social workers, and the disabled.

But in the grand scheme, that’s just 1% of the $1.75 trillion debt.

Black student loan borrowers want action, and they want it now. Collectively, Black people have about $52,000 in education debt on average, which 45% percent of that debt coming from graduate school studies. Jamiya Kornegay, one of the students you’ll meet in That’s The Point, discusses her $103,000 student loan debt from medical school.

“I would tell them to erase it completely,” says Kornegay, who is currently working in real estate to pay her bills in the meantime. “It affects people of lower socioeconomic status and people of color greatly. I feel like if we can donate billlions to other countries, we can take care of our people first.”

Check out the episode above, and subscribe to “That’s The Point” on theGrio’s YouTube channel!

Natasha S. Alford is VP of Programming and Senior Correspondent at theGrio. An award-winning journalist, filmmaker, and TV personality, Alford is writing her forthcoming book “American Negra.” Follow her on Twitter and Instagram at @natashasalford.

TheGrio is FREE on your TV via Apple TV, Amazon Fire, Roku and Android TV. Also, please download theGrio mobile apps today!